If you live in a hurricane-prone area, now’s a good time to check your insurance and how financially prepared you’d be if disaster were to strike.

While the 2019 Atlantic hurricane season has been a quiet one so far, Dorian has disrupted that. Now a Category 1 hurricane, the storm is forecast to strengthen as it continues churning toward the southeastern portion of the U.S., making landfall Sunday or Monday as a Category 3 hurricane (sustained winds of 111 mph or more).

Although it may be too late for homeowners in its path to make insurance changes, those who live elsewhere should take it as a reminder that the next big storm could be headed their way.

The Atlantic hurricane season started June 1 and runs through Nov. 30. The peak, however, is September.

And as temperatures rise and more moisture is held in the air, massive storms — some of which stall and dump torrential rainfall — have become more frequent in recent years.

“Flooding is the No. 1 disaster threat,” said Lynne McChristian, non-resident scholar for the Insurance Information Institute. “Pay attention to what’s happening elsewhere and realize it could be you.”

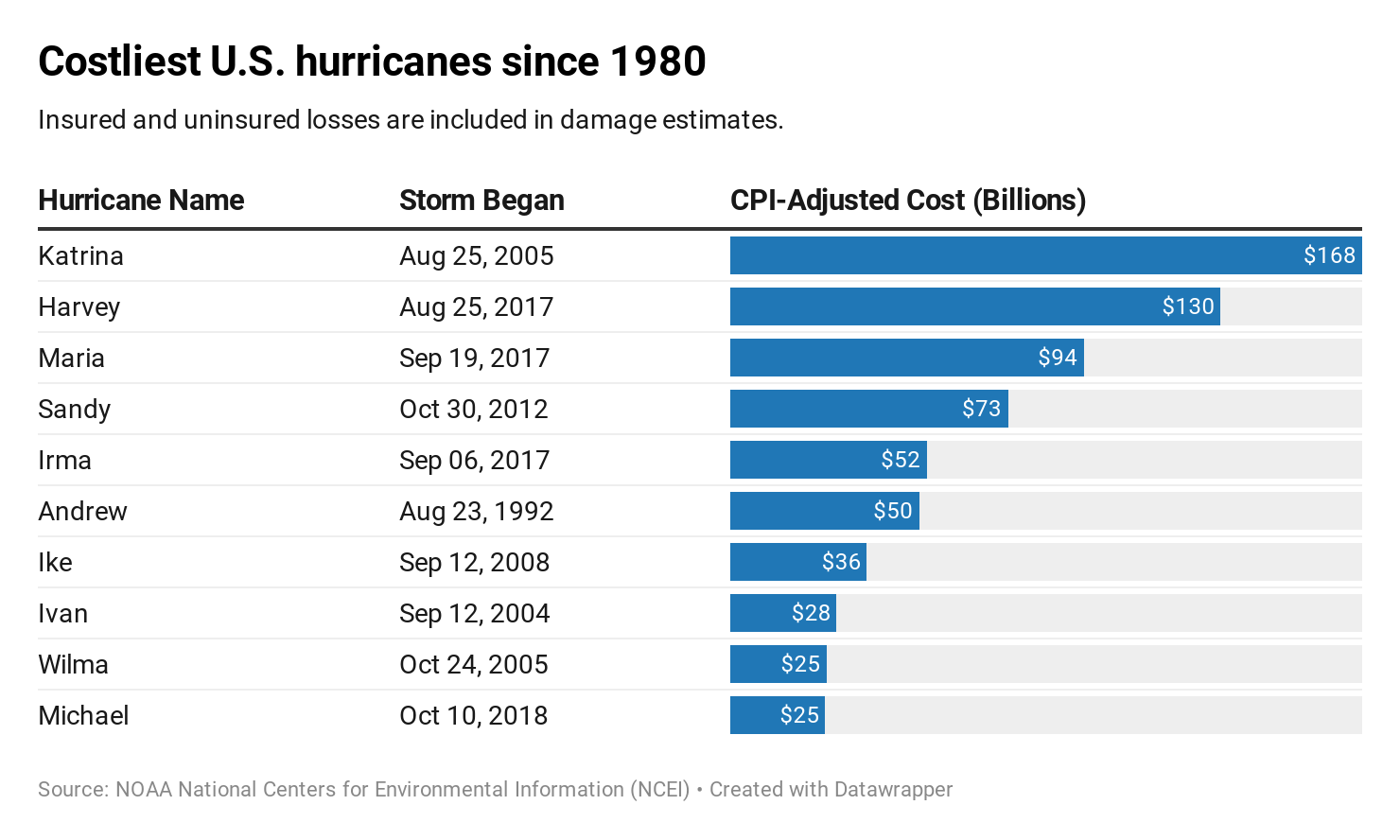

Last year, Hurricane Florence caused $24 billion in damage when it battered the Southeast in September, dumping nearly 36 inches of rain in some spots in North Carolina and causing widespread flooding and wind-related destruction. Hurricane Michael hit the panhandle of Florida in October, leaving $25 billion worth of damage in its wake.

Here are some tips to prepare for the next storm.

Safeguard important records and take photos

One of the last things you want to deal with when your home is damaged is not knowing where your important records are.

“There are some documents you will need right away after a disaster or tragedy strikes, and others that you may not need right away but will be very difficult to replace if they are lost or destroyed,” said Neal Stern, a CPA and member of the American Institute of CPAs’ Financial Literacy Commission.

Make sure records such as your insurance policies, title to your car, birth certificate and the like are safely stowed in a fire- and flood-proof lock box or similar option (i.e., a safe deposit box at a bank).

similar option (i.e., a safe deposit box at a bank).

Stern also recommends keeping copies of important documents in a location away from your home, such as with a relative or close friend. Or, if you have online cloud storage, you can keep copies there.

Additionally, before a storm hits, it’s worthwhile taking photos as a way to document your house and your belongings.

The idea is to have proof of what you own, along with a record of what kind of shape everything was in before the storm. If you can’t prove the prior condition of, say, your now-missing side door, it could cause snags or denials in the claims process if the insurance company has reason to question whether it was maintained properly.

Prepare for flooding

While most homeowners’ policies cover wind damage, they generally exclude flood damage. Yet floods are often what cause the most destruction.

“People are suffering flood damage in many parts of the country that never had it before and never thought they were vulnerable,” McChristian said.

For coverage, you’d need flood insurance through either the federal National Flood Insurance Program or a private insurer. Be aware, however, that there are coverage exclusions and limitations.

For example, a government flood policy won’t cover all of your belongings in your basement outside of things such as washers and dryers and water heaters. Separate insurance would be required.

Be aware, too, that flood policies take 30 days to become effective. The average yearly cost is $700, although that can vary widely, according to Insurance.com.

Check your hurricane deductible

There’s a good chance your homeowners insurance policy has a hurricane deductible. In 18 states and Washington, D.C., it’s a given. In others, it depends on your policy.

Either way, that deductible typically ranges from about 1% to 5%, depending on the specifics of your insurance contract. Some homeowners might opt for an even higher deductible if it’s available.

It’s important to note that the percentage is based on your insured value, not the damage caused. So if your home is insured for $200,000 and you have a 2% hurricane deductible, you’ll pay $4,000 even if the damage is just, say, $5,000.

This means it’s wise to have a plan to cover your share in the aftermath of a disaster.

“People should never take a higher deductible than they can afford,” McChristian said.

Renters are vulnerable, too

Even if you don’t own your home, your finances are still at risk if a storm damages the house or building you live in.

Renter’s insurance is an option for covering your belongings. It also can cover the cost living somewhere else if you can’t remain in your home after a storm.

The national average for a policy with $40,000 coverage for personal property, a $1,000 deductible and $100,000 of liability protection is $197 a year (about $17 a month), according to an Insurance.com rate analysis.

Rebuilding an older home

If you have an older home and it is substantially damaged, it has to be rebuilt according to current building codes. Chances are they are stricter than when your home was built.

“It can end up costing 25% to 50% more if you have to rebuild your home under a newer code,” McChristian said.

There’s an insurance policy for that. Called ordinance or law coverage (or something similar), it can cover the extra expenses involved in bringing your house up to code.